Given the steep increase in property prices in the recent times, a home loan is one of the best ways to finance your dream home. However, applying for a home loan is not as easy as it sounds. Even the simplest imperfection in the application can lead to rejection. One of the most crucial deciding factors in your home loan going through is the CIBIL score.

What is CIBIL score?

The Credit Information Bureau Limited (CIBIL) is a three digit number of your credit history. This score is determined using a credit history found in your CIR, a person’s credit payment history across loan types and credit institutions over a period.

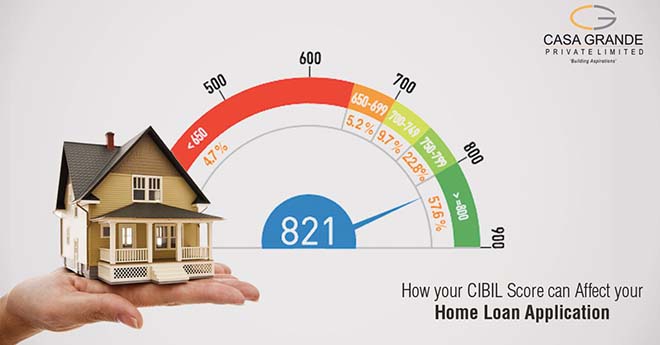

What is a good CIBIL score?

Minimum credit score needed for approval is usually 750+.

Excellent Credit 760+

Good Credit 700+

Fair Credit 640+

Home Loan and CIBIL score

Banks check CIBIL score to decide whether or not a particular applicant is eligible for a home loan and is one of the most crucial deciding factors. If you have a bad CIBIL score, banks immediately reject your home loan application. It also plays a vital role in determining your interest rates.

There are several reasons why one might have a bad CIBIL score. Some of the reasons include:

- Not paying/late payment of outstanding dues.

- Accounts going delinquent owing to delayed/no payment of EMIs.

- Non-payment of penalties.

- Having just unsecured loans such as personal loans will negatively affect your credit score.

How to improve your CIBIL score for a housing loan?

Anything below 350 is considered poor. If you have a bad credit history, you must work on increasing your CIBIL score.

- Make payments on time

The most important step towards improving your credit score is to make your payments on time. Whether it is a credit card payment or personal loan, ensure all dues are cleared ahead of time. In case you are paying by cheque, make sure you drop it off in advance itself.

- Increase your credit limit

If you are using a credit card, make sure your maximum spending limit is high. You don’t want a situation where you have spent over your limit. When you do that, it brings your CIBIL score down. If you keep your credit utilisation low, it will have a positive impact on your CIBIL score.

- Balance your credit portfolio

In general, there are two types of loans; secured and unsecured loans. Secured loans do not affect your CIBIL score while unsecured loans do. Try and close out all unsecured loans as quickly as possible. Unsecured loans indicate the need for personal funds and banks associates it with the ability to generate sufficient income to save.

Key steps to follow when you are applying for home loan

- Check your CIBIL score before applying

Know your CIBIL score before you apply for home loan. This will help you know the score and avoid possible rejection of your home loan application. You can check your CIBIL score online on CIBIL’s official website. It is a simple and quick process for a nominal price.

- Stop applying repeatedly

Do not keep applying for home loans repeatedly in case your home loan gets rejected by one particular bank or financial institution. This will only reduce your credit score further.